1. Brief Introduction of Cellulose Ether

Cellulose ether is a general term for a variety of derivatives obtained from natural cellulose (refined cotton and wood pulp, etc.) The resulting product is a downstream derivative of cellulose. After etherification, cellulose is soluble in water, dilute alkali solution and organic solvent, and has thermos plasticity. There are many kinds of cellulose ethers, which are widely used in construction, cement, paint, medicine, food, petroleum, daily chemical, textile, papermaking and electronic components and other industries. According to the number of substituents, it can be divided into single ether and mixed ether, and according to ionization, it can be divided into ionic cellulose ether and non-ionic cellulose ether. At present, ionic cellulose ether ionic products have mature production technology, easy preparation, relatively low cost, and relatively low industry barriers. They are mainly used in food additives, textile auxiliaries, daily chemicals and other fields, and are the main products in the market. product.

2. The main use and function of cellulose ether

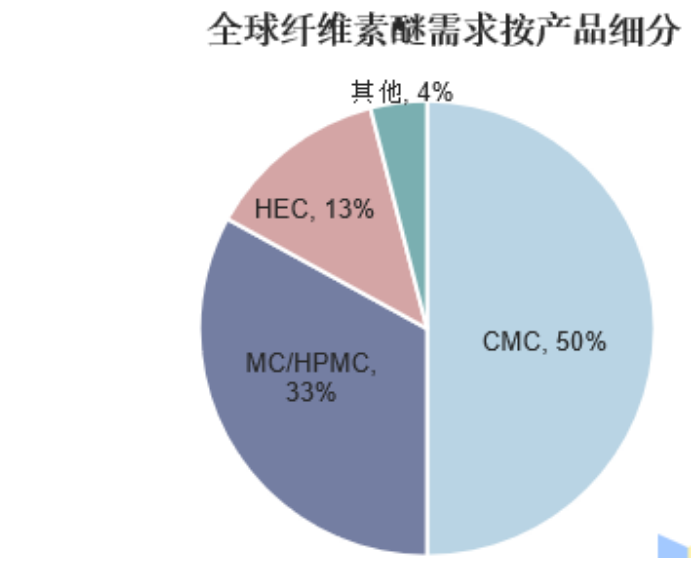

At present, the world’s mainstream cellulose ethers are CMC, HPMC, MC, HEC, etc. Among them, CMC has the largest output, accounting for about half of the global output, while HPMC and MC both account for about 33% of the global demand, and HEC accounts for about 30% of the global demand. 13% of the market. The most important end use of carboxymethyl cellulose (CMC) is detergent, accounting for about 22% of the downstream market demand, and other products are mainly used in the fields of building materials, food and medicine.

Global Cellulose Ether Demand Breakdown by Product

3. Downstream applications

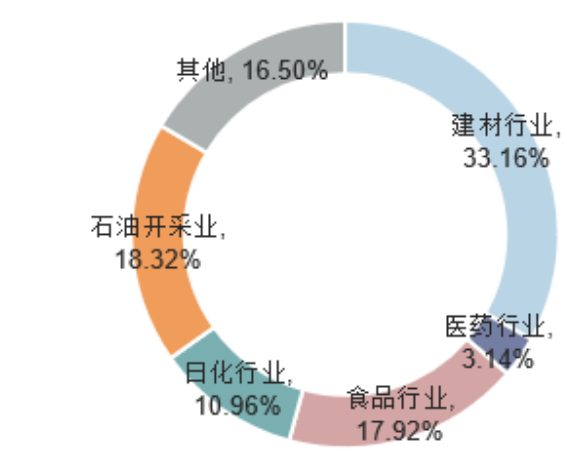

In the past, due to the limited development of my country’s demand for cellulose ether in the fields of daily chemicals, medicine, food, coatings, etc., the demand for cellulose ether in my country was basically concentrated in the field of building materials. Until today, the building materials industry still accounts for 33% of my country’s cellulose ether demand. %. The demand for my country’s cellulose ether in the field of building materials has become saturated, and the demand in the fields of daily chemicals, medicine, food, coatings, etc. is growing rapidly with the development of application technology. For example, in recent years, plant capsules with cellulose ether as the main raw material, and artificial meat, an emerging product made with cellulose ether, have broad demand prospects and room for growth.

The proportion of different downstream market share of cellulose ether in my country

Taking the field of building materials as an example, cellulose ether has excellent properties such as thickening, water retention, and retardation. Therefore, building material grade cellulose ether is widely used to improve the production of ready-mixed mortar (including wet-mixed mortar and dry-mixed mortar), PVC resin, etc., latex paint, putty, etc., including the performance of building material products. Thanks to the improvement of my country’s urbanization level, the rapid development of the building materials industry, the continuous improvement of the level of construction mechanization, and the increasing environmental protection requirements of consumers for building materials have driven the demand for non-ionic cellulose ethers in the field of building materials. During the 13th Five-Year Plan period, my country accelerated the renovation of urban shantytowns and dilapidated houses, and strengthened the construction of urban infrastructure, including accelerating the transformation of concentrated shantytowns and urban villages, orderly promoting the comprehensive renovation of old residential quarters, dilapidated old houses and non-complete sets Housing remodeling and more. In the first half of 2021, the area of newly started domestic residential buildings was 755.15 million square meters, an increase of 5.5%. The completed area of housing was 364.81 million square meters, an increase of 25.7%. The recovery of the completed area of real estate will drive the related demand in the field of cellulose ether building materials.

4. Market competition pattern

My country is a major producer of cellulose ether in the world. At this stage, domestic building material grade cellulose ether has been basically localized. Shandong HEAD is the leading enterprise in the field of cellulose ether in China. Other major domestic manufacturers include Shandong RUITAI, Shandong HEAD, North TIANPU Chemical, YICHENG Cellulose, etc. Coating-grade, pharmaceutical and food-grade cellulose ethers are currently mainly monopolized by foreign companies such as Dow, Ashland, Shin-Etsu, and Lotte. In addition to Shandong HEAD and other companies with a capacity of more than 10,000 tons, there are many small-scale manufacturers of non-ionic cellulose ethers with a capacity of 1,000 tons. High-end food and pharmaceutical grade products.

5. Import and export of cellulose ether

In 2020, due to the decline in the production capacity of foreign companies due to the overseas epidemic, the export volume of cellulose ether in my country has shown a rapid growth trend. In 2020, the export of cellulose ether will reach 77,272 tons. Although the export volume of my country’s cellulose ether has grown rapidly, the exported products are mainly building material cellulose ether, while the export volume of medical and food grade cellulose ether is very small, and the added value of export products is low. At present, the export volume of my country’s cellulose ether is four times the import volume, but the export value is less than twice the import value. In the field of high-end products, the export substitution process of domestic cellulose ether still has a lot of room for development.

Post time: Feb-23-2023